Comparing Top Institutional-Grade Crypto Index Strategies

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as financial advice. Always consult with a financial professional before making any investment decisions.

Amidst the buzz surrounding the potential launch of the first Spot Bitcoin ETF, the cryptocurrency market is abuzz with anticipation. Several industry players, including the likes of 21Shares, are already making strides, with applications for a Spot Ethereum ETF submitted to the US regulator, SEC. As the market evolves, it's only a matter of time before we see the introduction of a Spot ETF that encompasses a diverse range of digital assets, aiming to rival the institutional-grade fund-based crypto indexes currently dominating the scene.

Thanks for reading Riskbloq’s Substack! Subscribe for free to receive new posts and support my work.

Subscribed

In this analysis, the Riskbloq team delves into the strategies underpinning these existing indexes, speculating that similar methodologies might pave the way for the inaugural Spot Crypto Index ETF. Here, we compare five of the top institutional-grade crypto indexes available in the market.

Overview

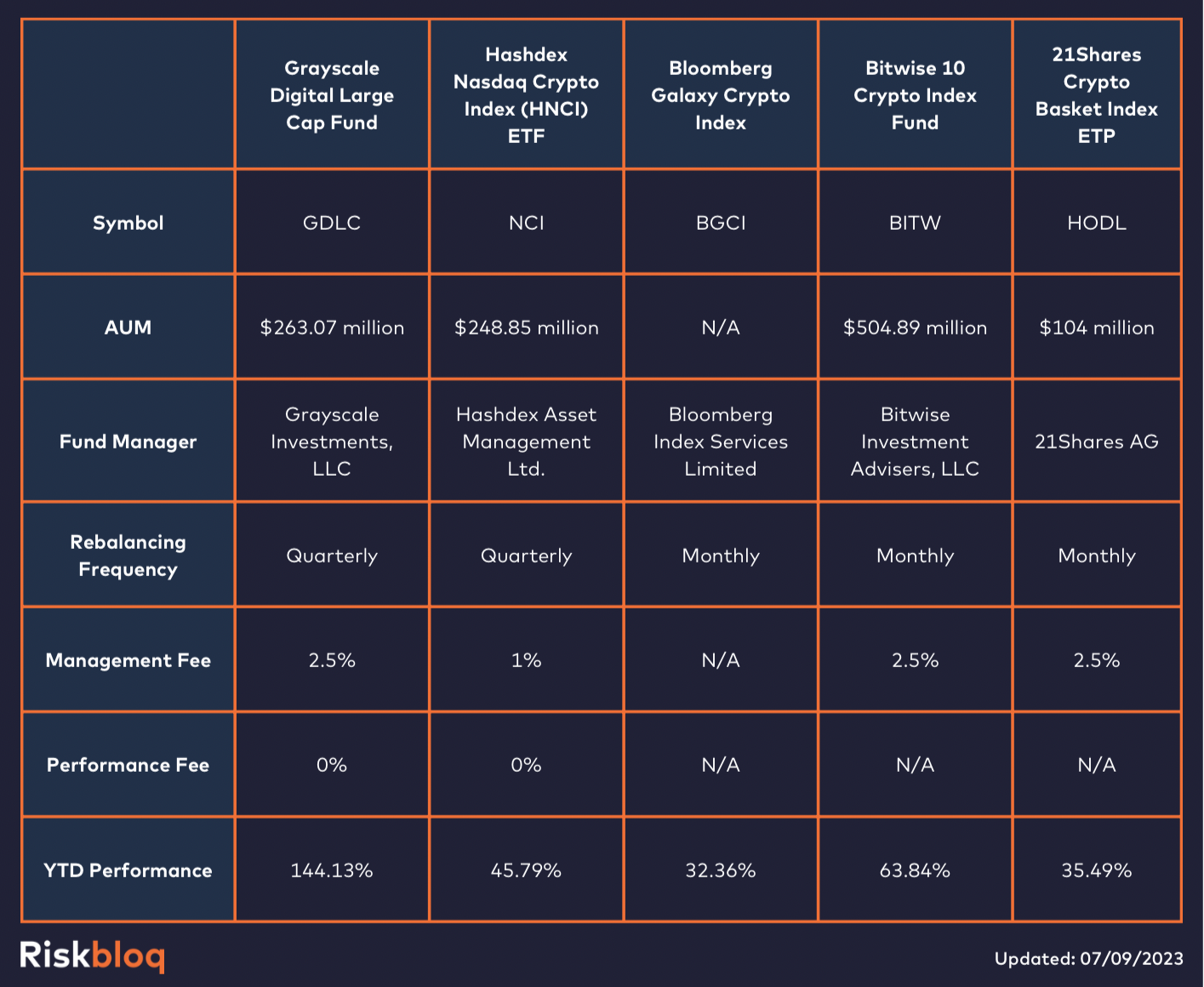

Performance: GDLC has the highest YTD performance, followed by BITW. HNCI and HODL have moderate returns, while BGCI lags behind.

Management Fee: HNCI offers the lowest management fee at 1%, while GDLC, BITW, and HODL charge 2.5%. BGCI's fee is not specified.

Fund Strategies

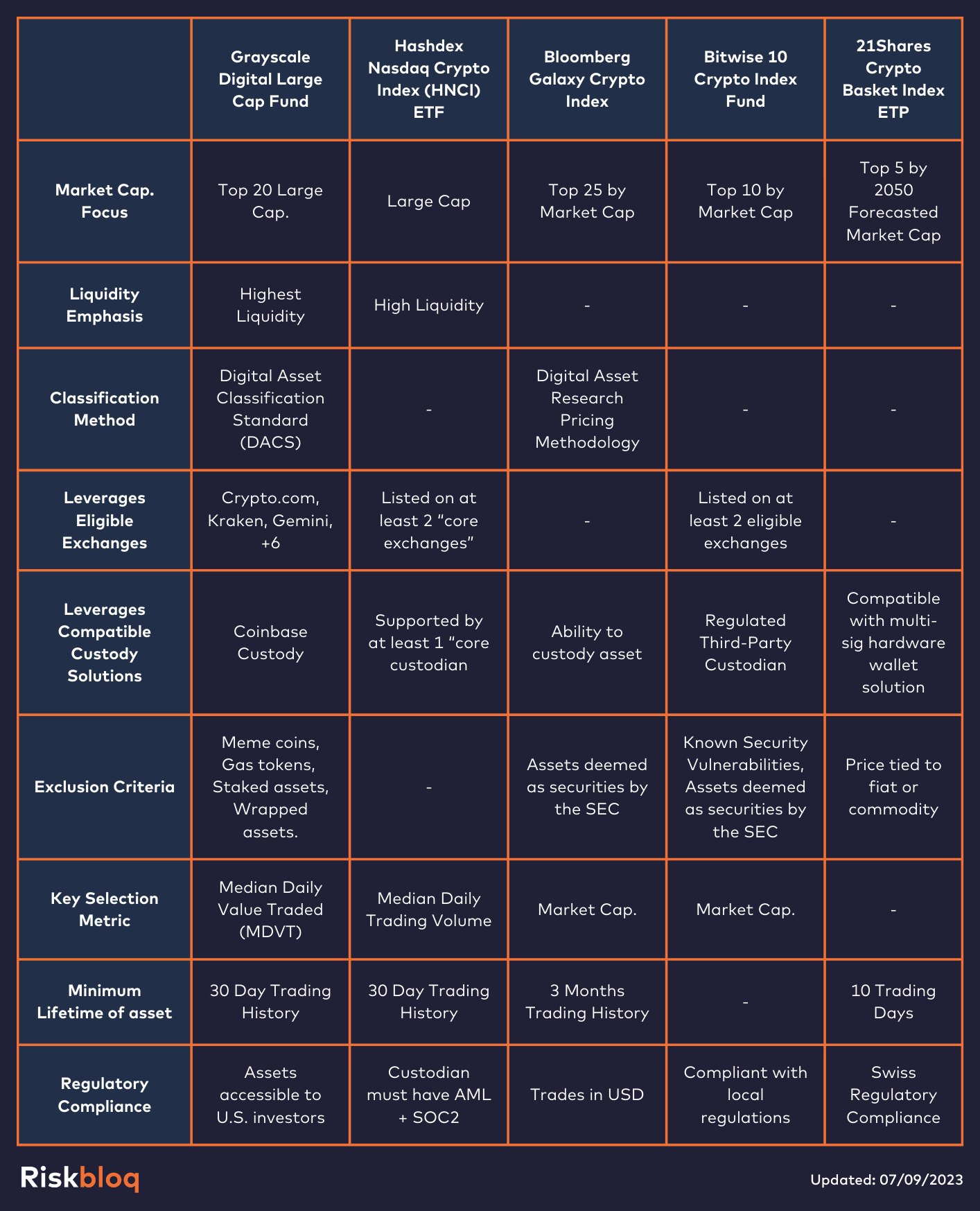

Market Cap Focus: Most indexes focus on top assets by market cap, but the depth varies. Grayscale and Bitwise focus on large-cap assets, while 21Shares uses a unique approach based on forecasted 2050 market capitalization.

Liquidity and Weighting: Grayscale emphasizes the highest liquidity, while HNCI uses a free-floating price for rebalancing. Weighting mechanisms also differ, with some like Bloomberg Galaxy using a cap/floor scheme and others like Bitwise and 21Shares focusing on market cap.

Exclusion Criteria: Each index has specific assets or types of assets they exclude, reflecting their risk management strategies. For instance, Grayscale excludes meme coins, while 21Shares avoids assets tied to fiat or ongoing ICOs.

Regulatory Compliance: Bitwise ensures its assets don't face undue risks of being deemed securities under U.S. federal securities laws, while 21Shares complies with Swiss regulations.

Fund Composition Comparison

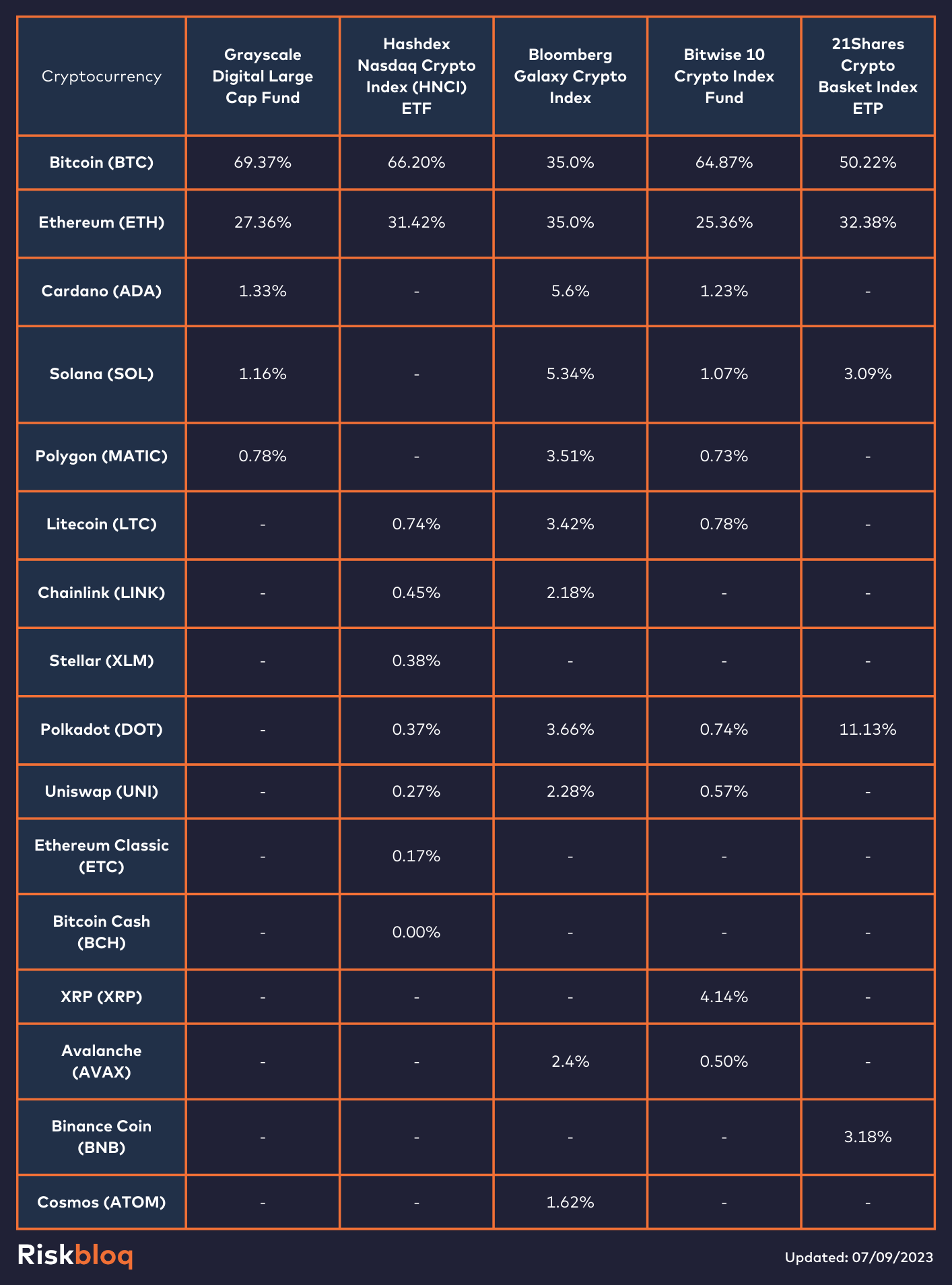

Dominance of Bitcoin and Ethereum: Across all indexes, Bitcoin (BTC) and Ethereum (ETH) emerge as the dominant assets, reflecting their status as the leading cryptocurrencies by market capitalization. Their allocations, however, vary, with Grayscale Digital Large Cap Fund and Hashdex Nasdaq Crypto Index (HNCI) ETF having the highest allocations towards BTC, while the Bloomberg Galaxy Crypto Index equally balances between BTC and ETH.

Diversification into Altcoins: Beyond BTC and ETH, the indexes diversify into various altcoins. Cardano (ADA) and Solana (SOL) are notable inclusions in Grayscale, Bloomberg Galaxy, and Bitwise 10. Polkadot (DOT) finds representation in HNCI, Bloomberg Galaxy, Bitwise 10, and 21Shares, indicating its growing prominence.

Unique Asset Choices: Some indexes have unique asset choices not found in others. For instance, XRP is exclusively part of the Bitwise 10, while Binance Coin (BNB) is unique to the 21Shares Crypto Basket Index ETP.

Varied Diversification Depth: The depth of diversification varies among the indexes. While some like Grayscale and HNCI ETF primarily focus on a few top assets, others like Bloomberg Galaxy and Bitwise 10 offer a broader range of cryptocurrencies in their composition.

Conclusion

Across institutional-grade crypto indexes, Bitcoin and Ethereum consistently dominate, but allocation percentages vary. Altcoins like Cardano, Solana, and Polkadot are gaining traction in multiple indexes. Strategies differ with Grayscale emphasizing liquidity, Hashdex focusing on free-floating price, and 21Shares using forecasted 2050 market caps. Exclusion criteria and regulatory compliance further differentiate these indexes. As the buzz around Spot Bitcoin and Ethereum ETFs grows, these indexes provide valuable insights into potential future strategies for upcoming ETFs.

About Riskbloq

Riskbloq's mission is to simplify digital asset discovery for professional investors and we're doing this by building a platform that generates simple-to-understand risk profiles for each available digital asset. Our profiles are made up of risk scores that ingest critical data points for professional investors to form a view of market opportunities.

We are building the world's most comprehensive digital asset Risk Management platform. "Moody's for Crypto"

References:

CoinDesk Large Cap Select Index (DLCS), https://www.coindesk.com/indices/dlcs/

Digital Asset Classification Standard (DACS) Glossary, https://downloads.coindesk.com/cd3/CDI/Digital+Asset+Classification+Standard+Methodology.pdf

CoinDesk Index Govenance, https://www.coindesk.com/indices/crypto-index-governance

CoinDesk Large Cap Select Index Methodology, https://downloads.coindesk.com/cd3/CDI/CoinDesk+Large+Cap+Select+Index+Methodology.pdf

CoinDesk Digital Asset Indices Policy Methodology (Exchange Eligibility) - https://downloads.coindesk.com/cd3/CDI/CoinDesk+Digital+Asset+Indices+Policy+Methodology.pdf

How Digital Assets Get Into Investable Indices, https://www.coindesk.com/markets/2022/11/07/how-digital-assets-get-into-investable-indices/

Hashdex Nasdaq Crypto Index (HNCI) ETF, https://hashdex.com/en-KY/products/hdexbh

Nasdaq Crypto Index Methodology, https://hdx-prd-web-cms-upload-bucket.s3.amazonaws.com/methodology_NCI_1_0de4da2a1c.pdf

Bloomberg Galaxy Crypto Indices Fact Sheet, https://assets.bbhub.io/professional/sites/10/BGCI-Factsheet-Sept-2023.pdf

Bloomberg Galaxy Crypto Indices Methodology, https://assets.bbhub.io/professional/sites/10/Bloomberg-Galaxy-Crypto-Index-Methodology-Feb-22.pdf

Bloomberg Galaxy Crypto Index Market Data, https://www.bloomberg.com/quote/BGCI:IND

Bitwise 10 Crypto Index Fund Fact Sheet, https://s3.amazonaws.com/static.bitwiseinvestments.com/FactSheet/bitwise10/Bitwise-10-Crypto-Index-Fund-Fact-Sheet.pdf

Bitwise 10 Crypto Index Fund Methodology,

The Bitwise Crypto Index Methodology , https://s3.amazonaws.com/static.bitwiseinvestments.com/Bitwise-Crypto-Index-Methodology.pdf

21Shares Crypto Basket Index ETP, https://cdn.21shares.com/uploads/current-documents/factsheets/HODL/21shares%20HODL%20ETP%20Factsheet.pdf

21Shares Index Guide, https://cdn.21shares.com/uploads/current-documents/21Shares_Index_Guide.pdf