Spot ETFs vs. Futures ETFs: Unraveling the Differences

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as financial advice. Always consult with a financial professional before making any investment decisions.

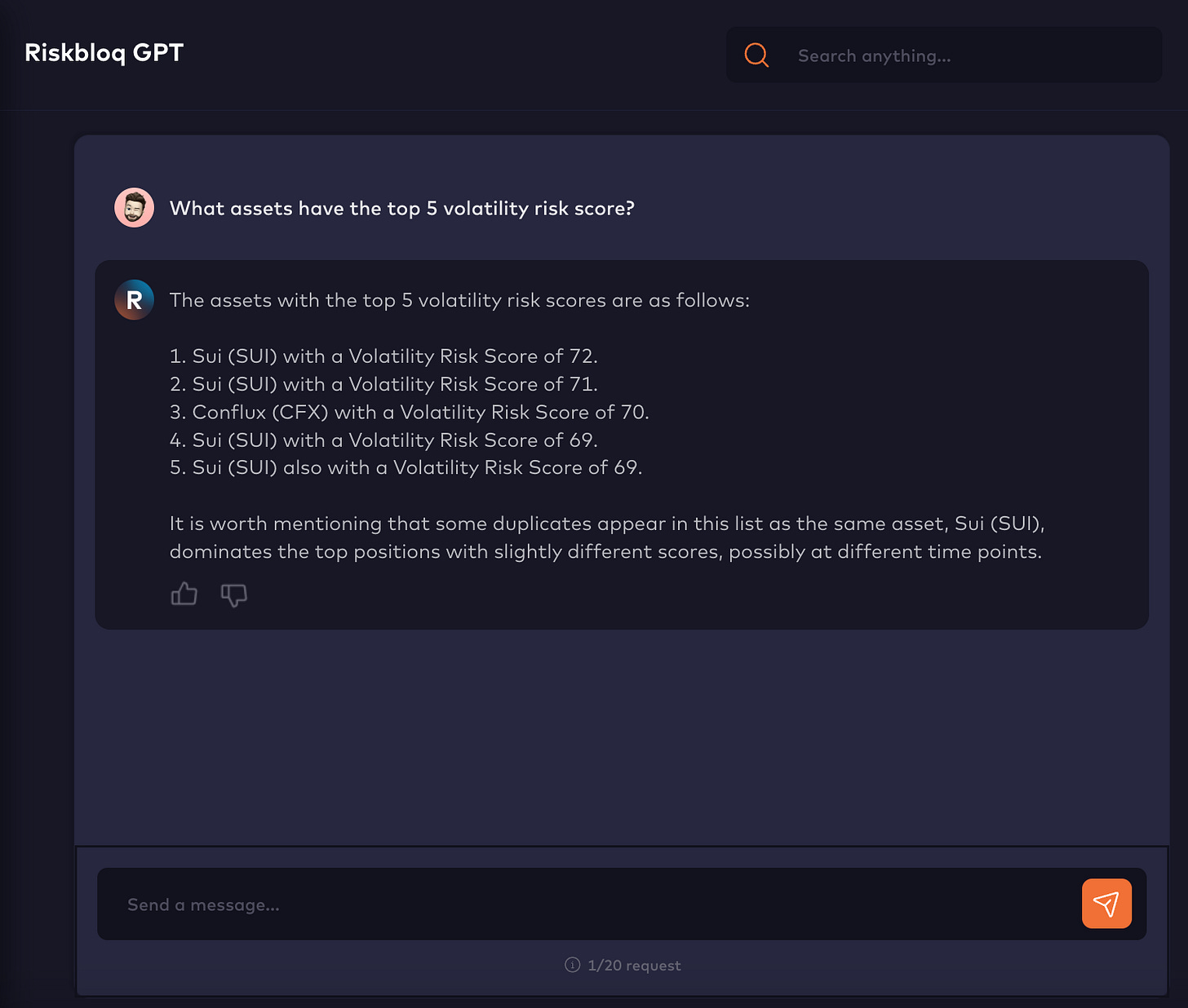

In the ever-evolving landscape of cryptocurrency investment, Exchange-Traded (ETFs) have emerged as popular vehicles for gaining exposure to digital assets. Among these, Spot ETFs and Futures ETFs stand out as two distinct investment options each with its unique characteristics and implications for investors. In this article, we delve into the differences between Spot ETFs and Futures ETFs shedding light on their features, benefits and considerations for investors navigating the crypto market. As we delve into the implications of this development, it's worth noting a valuable resource for enthusiasts seeking to gauge the risk and volatility of leading digital assets – the volatility scores are conveniently available on RiskbloqGPT.

Subscribed

Exploring Futures ETFs: Derivative-Based Investment Vehicles

On the other hand, Futures ETFs are derivative-based investment vehicles that track the price of cryptocurrencies through futures contracts. Rather than holding the actual digital asset, Futures ETFs invest in futures contracts that speculate on the future price of the underlying asset. These contracts allow investors to bet on the future price movements of cryptocurrencies without needing to own the assets themselves. Futures ETFs can provide exposure to cryptocurrencies with less capital upfront, as they require lower initial investment than Spot ETFs. However, they also come with risks associated with futures trading, such as counterparty risk and potential for leverage.

Key Differences and Considerations for Investors

One of the primary differences between Spot ETFs and Futures ETFs lies in their underlying assets. Spot ETFs offer direct exposure to cryptocurrencies, providing investors with ownership of the digital assets themselves. In contrast, Futures ETFs derive their value from futures contracts, which can introduce additional complexities and risks into the investment. While Futures ETFs may offer cost-effective ways to gain exposure to cryptocurrencies, they also come with inherent risks associated with derivatives trading.

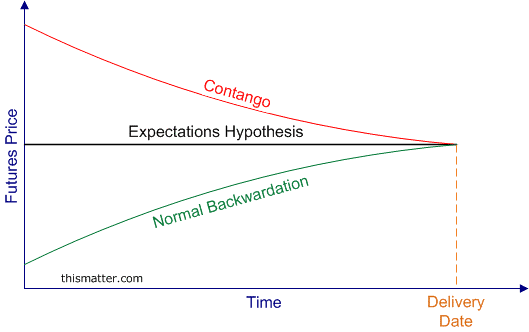

Another important consideration for investors is the impact of contango and backwardation on Futures ETFs. Contango occurs when futures prices are higher than spot prices, leading to a negative roll yield for ETF investors. Conversely, backwardation occurs when futures prices are lower than spot prices, resulting in a positive roll yield for ETF investors. Understanding these concepts is crucial for investors evaluating the performance and potential risks of Futures ETFs.

Graph of contango and backwardation | Source: thismatter.com

In the realm of cryptocurrency investing, understanding and managing risk is paramount. Riskbloq GPT provides investors with risk scores for digital assets, leveraging advanced AI technology to analyze factors such as market volatility, liquidity, and regulatory environment. With Riskbloq GPT, investors can make informed decisions by comparing the risk profiles of assets held by Spot ETFs and those tracked by Futures ETFs.

RiskbloqGPT Output for volatility scores.

Final Thoughts

In summary, Spot ETFs and Futures ETFs offer distinct pathways for investors to gain exposure to cryptocurrencies. While Spot ETFs provide direct ownership of digital assets and track real-time prices, Futures ETFs offer derivative-based exposure through futures contracts. Investors should carefully consider their investment objectives, risk tolerance, and understanding of derivatives trading when choosing between Spot ETFs and Futures ETFs. By unravelling the differences between these two investment options, investors can make informed decisions that align with their financial goals and preferences in the dynamic world of cryptocurrency investing.

Riskbloq's mission is to simplify digital asset discovery for professional investors and we're doing this by building a platform that generates simple-to-understand risk profiles for each available digital asset. Our profiles are made up of risk scores that ingest critical data points for professional investors to form a view of market opportunities.

We are building the world's most comprehensive digital asset Risk Management platform. "Moody's for Crypto"